Nowadays, e-commerce sales are increasing more quickly than ever. According to insider information, only US retail eCommerce sales will increase 16.1% in 2022 to $1.06 trillion.

A 2022 research article also claims that, up 10% from 2020, more than 56% of customers prefer to shop online.

Individuals give trustworthy brands additional personal and financial information when more people make purchases online. This makes it essential for you to invest in PCI compliance for your eCommerce website.

Unfortunately, hackers emerge from hiding to try and steal the sensitive authentication data that users share online. Additionally, if your business accepts payments online, you are on their target list.

According to research, hackers aren't stopping. Peak fraudulent login attempts went between 84.71% to 93.84% in a year, an increase of 9.13%. Several of the largest e-commerce businesses, including Facebook, Amazon, and Bonobos, have experienced data breaches in the previous 18 months.

While people prefer to shop online, businesses and merchants must realize that customers will only use your business if they feel secure shopping there. Because they didn't trust the website with their credit card information, 18% of consumers abandoned their carts.

Interested in our E-commerce Development Solutions?

The eCommerce website development industry knows Payment Card Industry Data Security Standard is referred to as PCI DSS compliance. The Payment gateway integration developed this information security standard to strengthen the controls, procedures, and checks that guard cardholder data.

As per eCommerce website development services, any business that receives, processes, or transmits credit card information from companies, including American Express, Visa, Discover, Mastercard, and JCB, is subject to this regulation.

eCommerce website development services know that the PCI DSS was created by the PCI SSC, which was established in December 2004 by major credit card companies. The PCI DSS standards have undergone numerous updates since that time, according to PCI SSC. In March 2022, PCI DSS v4.0, the most recent revision, was made available.

Becoming PCI-compliant eCommerce has advantages beyond protecting your business and your customers' data. An eCommerce site that is safe fosters greater levels of customer confidence, which is essential for generating recurring business.

Additionally, adhering to the PCI requirements checklist builds a solid platform for compliance with other laws while enhancing your standing with crucial business partners. Being PCI compliant implies you not only support your organization's security policies but also significantly advance international security initiatives.

The council's document states that the PCI DSS v4.0 includes the following modifications:

Extending the use of multi-factor authentication and changing password requirements in order to continuously meet the security demands of the payments sector.

Improving security is an ongoing process to prevent cybercrime. One illustration is adding instructions to aid users in setting up and maintaining security.

Increasing organizational flexibility to support the development of new payment application models. The use of shared, group, and generic accounts are permitted.

Improving validation techniques and approaches to promote transparency. Improved reporting is part of PCI Compliance eCommerce.

The goal of PCI compliance requirements checklist standards is to safeguard card issuers and cardholders by ensuring that merchants adhere to international operational, technical, and security standards for the protection of all payment data.

You might be asking if becoming PCI-compliant eCommerce is mandatory. Yes and no, I suppose.

Technically,eCommerce PCI compliance is not required by US federal law, but certain states do. Additionally, when your firm reaches a certain size, PCI compliance eCommerce is required by all significant credit card issuers.

Credit card issuers have the following options if you don't comply:

According to an eCommerce website development, any retail organization that engages in transactions with the main credit card providers is required by those programs to abide by the PCI DSS regulations.

Credit card information is accessible to retailers, and it is not merely kept by them in a closed box. It is transmitted and processed, frequently with the assistance of outside vendors with whom the store may conduct business.

Retailers can therefore identify the essential policies, controls, or practices they need to implement to assist mitigate cyber risks particular to the retail industry by adhering to the PCI DSS requirements.

Avoiding penalties is not the goal of complying with eCommerce PCI compliance rules. It's about safeguarding your clients' private information. The legitimacy of your company and the confidence of your consumers both rise when you take every precaution to lessen the possibility of data breaches.

When a customer checks out, your SSL should transmit their credit card details to your merchant account. In this manner, a third party that handles credit cards instead of your database will receive the encrypted card number. The credit card information shouldn't be kept in your database.

Storing the numbers could lead to security problems since if your website administration were hacked, credit card numbers could be taken.

As a result of Russian agents hacking into the company's database and compromising three billion accounts in 2013, Yahoo! is blamed for the greatest data breach in history.

Here are a few instances of the most recent retail credit card data breaches.

Neiman Marcus uncovered a data breach in 2021 that resulted in the compromising of 4.6 million user accounts. Customer names, passwords, contact information, user names, credit card numbers, and even virtual gift cards were among the stolen data. Neiman Marcus required all customers to reset their passwords as a result of the data incident.

Following a phishing fraud, Next Level Apparel alerted customers in a press release in 2021. Social Security numbers, credit card numbers, primary account numbers, and license numbers were among the data that hackers improperly accessed. As a result, NLA offered its clients improved email security standards and more protection safeguards.

Due to a "known vulnerability in Magento," hackers attacked 4,151 eCommerce stores in 2021 over the largest shopping weekend of the year.

Hackers gained access to the majority of these self-hosted Magento eCommerce stores, which contained customer and payment information. The Active Cyber Defense program of the UK's NCSC discovered the security hole and advised retailers to implement strict security updates.

Based on whether you are a service provider or a merchant, your compliance level will change. There are four main compliance levels available to eCommerce merchants, and each one may alter significantly due to the credit card system.

How many transactions you conduct annually through each credit card provider will help you calculate your PCI compliance level. To assist you in determining your own, let's take a deeper look at Discover, Visa, and Mastercard's compliance levels.

The greatest degree of compliance is Level 1. It is intended for businesses that handle over six million transactions a year. All payment providers that handle more than 300,000 transactions annually are also included at this level.

The requirements for eCommerce PCI compliance Level 1 validation include:

A Qualified Security Assessor (QSA) must execute a quarterly network scan and verification of compliance in addition to an annual report on compliance (ROC).

For businesses that handle one million to six million transactions yearly, Level 2 is the appropriate level. It also includes payment intermediaries that handle less than 300,000 transactions annually.

The requirements for PCI compliance Level 2 verification include:

Level 3 is for mid-sized eCommerce businesses that handle 20,000–1,000,000 transactions annually.

The requirements for PCI compliance eCommerce Level 3 validation include:

Level 4 is for businesses that handle fewer transactions annually. Level 4 merchants are those who handle under 20,000 transactions annually.

The requirements for PCI compliance eCommerce Level 4 validation include:

Not whether you must accomplish PCI compliance is the question. You do. What platform type should you select in order to achieve PCI compliance?

There are various software solutions that can help your eCommerce web design become PCI compliant, just as there are various options for building, operating, and hosting websites online (such as self-hosted, dedicated, or shared).

What you decide will rely on the size, knowledge, resources, IT personnel, and objectives of your store.

The three primary eCommerce PCI compliance platform types are shown below, along with details on how to be compliant on each of them:

Similar to WordPress, open-source software for PCI compliance eCommerce allows you to view the source code and apply your own security-enhancing modifications.

You will have to pay for your hardware with this choice, but you will not be concerned about purchasing a software license.

For major eCommerce website development services with developers that write their own code yet want to automate inflow control, open-source software is a suitable option. In other words, open-source software will enable the development of your online business while providing the assurance that non-compliant elements won't enter the codebase.

The bottom line: If you're building a highly customized e-commerce store or application with original code rather than using a platform like Shopify, but you lack the funds or the technical know-how to take advantage of a commercial PCI compliance solution, open-source software may be the right choice for you.

Choosing dedicated hosting for a website is similar to purchasing certified commercial PCI software.

You purchase and retain your own technology and commercial software license, saving money instead of hiring a hosting company to assist you with all the details of becoming PCI compliant eCommerce. This approach leaves licensing and certifying your store entirely up to you, albeit using commercial PCI software will make it simpler.

Large, well-known eCommerce stores with the following characteristics generally choose these specialized commercial PCI solution providers:

The bottom line is that this choice is excessive and not for you if you're expanding your new eCommerce store, don't need to monitor millions of transactions, or are just learning about eCommerce PCI compliance.

Similar to constructing a website on a shared hosting platform, using a hosted eCommerce PCI compliance SaaS solution.

Hosted SaaS is a common feature of large eCommerce sites (like Shopify). In other words, since Shopify is built with PCI compliance, you may launch a Shopify store without worrying about the privacy of your website.

Because they are housed on a framework like Shopify, the majority of eCommerce sites normally don't need to take any special steps to become PCI compliant, according to an eCommerce website development.

However, it's important to keep in mind that if you're a Level 2-4 merchant, you'll still need to complete a self-assessment questionnaire regardless of whatever option you select (even hosted).

You must complete the survey and a ROC if you are a Level 1 merchant.

The bottom line: If you're creating an online store using a platform like Shopify, you should choose this option. You won't need to spend a lot of money on licensing or hardware, and you can easily maintain eCommerce PCI compliance.

The good news is that your store will already be PCI compliant if you base it on a Saas platform like Shopify. You won't need to stress about reiterating strict procedures every year to guarantee PCI compliance.

The best piece of advice for a new e-business owner is to select a solution that is already PCI compliant eCommerce so that you are secured by default. According to an eCommerce website construction company, PCI compliance is incredibly expensive and not realistic for small firms. Bigger, more established stores can invest in it.

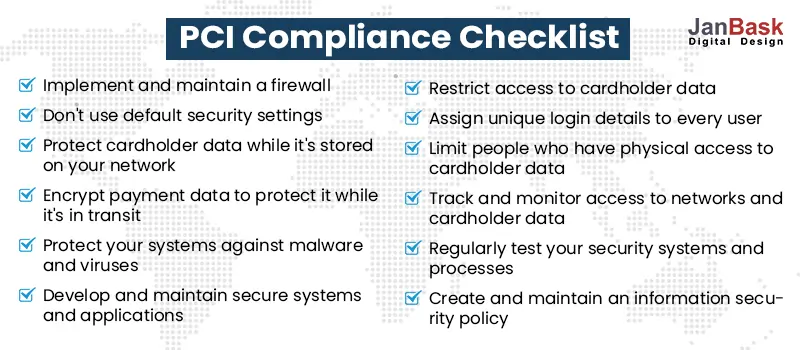

Your IT team must take these 12 steps whether you decide to invest in a for-profit PCI platform or an open-source PCI compliance eCommerce platform.

Although this is a high-level summary, it is advisable to review the PCI DSS criteria.

A firewall must be installed to secure cardholder data when network security controls (NSCs) are to be maintained. This entails setting up and maintaining NSCs correctly, restricting access to your cardholder data environment (CDE) to trusted traffic only, and establishing a highly secure area for the storage of all card data.

Hackers frequently try to access critical data by utilizing systems' default password settings. Apply safe configurations to components because default passwords can be easily guessed using publicly available information. Make stronger passwords and alter them as well.

Make sure you have security measures like truncation, point-to-point encryption, masking, and hashing if you're storing sensitive data like credit card numbers. Make every effort to reduce dangers.

This entails not keeping extra information on hand, truncating card information, and avoiding communicating private information via instant messaging or email.

Use robust cryptography to safeguard data, especially when transferring it through networks that are prone to attack—preferably public networks.

Trojans, viruses, spyware, worms, rootkits, ransomware, and links are examples of malware. These are used by hackers to break into a computer system. Use antivirus and anti-malware software to protect your cardholders.

Ensure that only authorized systems with a need-to-know basis can access vital data. Make regulations that only allow IT staff to perform the necessary jobs by giving them the right access and privileges.

Utilize vendor-provided security patches, keep an eye on your software lifecycle (SLC), and use secure coding practices to thwart hackers. Make that the system's components have the latest malware and compromise-protecting software updates.

Minimize physical access to protect the transit of cardholder data. This entails discarding any tangible documentation containing sensitive information, including hard copies. If you do require printed copies, keep critical material to a minimum.

Identify users' identities and put in place a verification procedure to authenticate users. Consider requesting identification from users to confirm their identity.

Setting up logging methods and monitoring user activity is a crucial step in safeguarding cardholder data. In the event of a breach, logs on system elements aid in tracking, editing, and analysis.

Don't put off verifying the protection of your system because hackers never sleep. Use tools, procedures, and test networks to often stress-test your security.

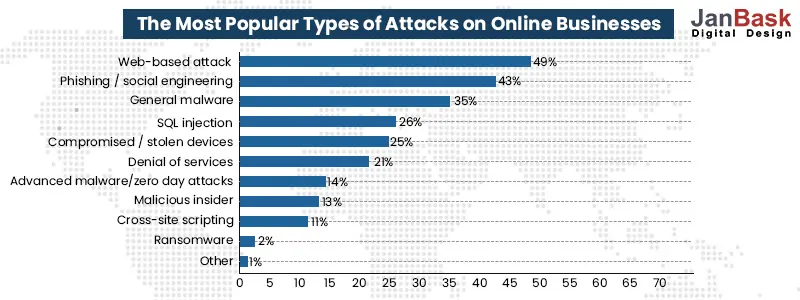

In today's high-tech world, hackers are ubiquitous, and they are getting smarter all the time. According to reports, there were 2,084 ransomware reports between January and July 31, 2021, a 62% increase from the previous year.

E-commerce businesses need to act now to tighten security as the internet develops and hackers become more skilled.

The following PCI compliance requirements checklist is the best approach to protecting sensitive data and keeping consumers' trust.

Following PCI SSC guidelines guarantees that you've put the best measures in place to defend against cyberattacks and lessen the risks that affect retail enterprises as per eCommerce website development.

Furthermore, many credit card payment systems won't let you store, transmit, or even conduct credit card transactions if you can't demonstrate that your e-commerce store is PCI compliant.

Gaining your consumers' trust is essential for growing an e-commerce firm, and you can't do that if their data isn't secure with you.

Spend some time writing out your compliance and security details. Then, inform every employee about your compliance procedures and how they may play a vital part in safeguarding the data of your clients.

Ans. If your business is PCI Compliant, it indicates that it complies with all PCI Data Security Standard criteria and is committed to protecting consumer data.

A set of guidelines known as PCI compliance is intended to guarantee the security of credit card data held on computer systems. For the purpose of enhancing data security and preventing fraud, the payment industry developed these standards.

Ans. For eCommerce businesses that handle financial transactions, store credit card data, or take payments from customers using debit cards, credit cards, prepaid cards, and other payment methods, PCI compliance eCommerce is necessary. You run the danger of receiving a fee or having your account closed if you don't comply. Even worse, you run the risk of losing the confidence of your clients and damaging your brand.

Being PCI compliant eCommerce is essential since it has an impact on every area of your company.

Ans. PCI compliance demands that small firms manage firewalls, maintain antivirus software, assign unique IDs to each user with computer access, and encrypt cardholder data.

Employing eCommerce development services can help you with the procedure and assessment. The greatest answer for your brand might be suggested by experts once they have fully comprehended your company.

When it counts, it's up to you to safeguard critical data like credit card numbers and other client information.

The best method to safeguard consumer data is with a little assistance unless you are a highly competent developer with experience protecting eCommerce sites and guaranteeing they are 100% PCI compliant eCommerce.

To protect your customers' credit card information, it is therefore best to enlist the assistance of a professional ecommerce development company like JanBask Digital Design. You can be confident that your online store will be PCI compliant eCommerce when you put it up.

N

This information is very helpful.

B

Is there more that you recommend on this topic?

J

Thanks for your interest, please contact at info@janbaskdigitaldesign.com for your specific queries.

B

Could you please help me with this for my local business?

J

Thanks for your interest our team will definitely help you, please contact at info@janbaskdigitaldesign.com

S

Thank you team for guiding me in the process.

P

You have a knowledgeable team.

J

Thanks Phoenix, stay connected for more such blogs.

L

Your guidance helped my eCommerce business.

J

Glad it helped you!

J

This information on the PCI compliance checklist is beneficial.

A

Is there more that you recommend on this topic?

Z

Could you please help me with the PCI compliance requirements checklist for my local business?

E

Thank you, team, for guiding me in the process.

K

You have a knowledgeable team.

A

Your guidance helped my eCommerce business

M

Thank you for providing such an invaluable guide on PCI compliance for eCommerce businesses.

E

Your blog provides a clear and concise guide to PCI compliance for eCommerce businesses.

R

I appreciate the detailed explanations and step-by-step guidance you’ve included.

H

Thank you for this comprehensive guide on PCI compliance for eCommerce. It’s an area that many online businesses struggle with, and your article provides clear and practical guidance.

E

Your blog provides a clear and comprehensive guide to PCI compliance. It’s a must-read for anyone handling sensitive data or working in the payment industry.